Money, Money, Money: The Socialization of Financial Literacy

Published in:

November 16–17, 2012

Dillard University and Xavier University of Louisiana

New Orleans, Louisiana

Financial Social Work

Little research exists on the attitudes, beliefs, and perceptions of money practices of household structures. In today’s economy, almost everyone is being forced to make financial choices as the cost of gas, food, and clothing surge and incomes remain flat and unemployment high. Therefore it is essential for social scientists to study the money practices within families to advance economic stability and financial wellness of individuals, families, and communities, with particular attention to vulnerable populations. Financial Social Work is a multidisciplinary approach that helps individuals and families build upon and/or acquire new knowledge about a variety of money management topics, and to help them to develop and refine skills needed to practice money management skills (Center for Financial Social Work, Inc. 2012).

Financial Social Work is a multidisciplinary approach that helps individuals and families build upon and/or acquire new knowledge about a variety of money management topics, and to help them to develop and refine skills needed to practice money management skills (Center for Financial Social Work, Inc. 2012). The financial status of American families varies from one family to another. The value of money and the way that it is spent or saved differ based on the individual or family. Some may place a large emphasis on saving and living on a budget to help prepare for unexpected events. Others spend their money based on what they feel is necessary to have or what makes them content. These particular people may focus more on tangible things or materialistic things that allow them to maintain a certain degree of happiness or satisfaction. Some spend to fit into a certain social status or group.

Development of Research Project

Johnson C. Smith University is serious about providing faculty and students with the most current, valid, and reliable research methods and tools. The Smith Institute for Applied Research awards pilot funding for faculty-led and student-mentored research. Smith Institute concentrates on specific research questions that address some of the most pressing issues of our day.

One of the presidential priorities at Smith Institute for Applied Research is to help faculty and students conduct research projects within the surrounding area of the university known as Charlotte’s Northwest Corridor. The emphasis of the research projects is community revitalization, health, safety and wellness, housing, and education.

In the summer of 2012, the author was awarded an applied research award to implement a community-based research project within Charlotte’s Northwest Corridor. The research project was conducted in a Financial Social Work course. The course was offered as an elective within the undergraduate social work program in the Metropolitan College at Johnson C. Smith University. The Metropolitan College is geared toward adult learners who work full-time and attend school at night. The course was designed to teach students how people are socialized about money, how family structure impacts family financial management, and how levels of financial literacy vary.

Little research exists on the attitudes, beliefs, and perceptions of money practices of household structures. The traditional nuclear family–children living with married biological parents–has been the implicit household norm in the economics of the family (Lundberg & Pollak, 2007). Families in the United States today are no longer characterized by two first-time married parents who live blissfully together with their 2.5 children. As of 2004, only 23 percent of all families included children living with their own biological married parents in a household, reflecting a decline from 40 percent in 1970 (Fields, 2004).

Non-marital childbearing has increased dramatically in the United States over the past three decades. The number of live births per thousand unmarried women grew from about 25 in the early 1970’s to over 44 today. The percentage of births occurring outside of marriage has increased as well. Whereas in 1970, approximately 12% of all births were to unmarried mothers, today over a third occur outside marriage (Sigle-Rushton & McLanahan, 2002).

Today’s families are more likely to reflect a varied medley of structures and configurations. Family structure is the “nuclear family as well as those non-traditional alternatives to nuclear family which are adopted by persons in committed relationships and the people they consider to be family” (Commission of the Social Work Education, 2002.)

The families within Charlotte’s Northwest Corridor consist of these medleys of family structures. According to the Soul of the Community (2012) study, the average family size in the corridor consist of 3.2 members. Families structures consist of the following composition: married families without children (19.9 %); married couple families with children (7.3 %); and single-mother households (24.9 %).

According to Sherridan (2010) several factors contribute to lack of assets in poor households. They are:

- Low wage employment and low levels of education contribute to low income that strains families’ ability to accumulate assets, especially among women and families with children;

- Low levels of wealth in one generation beget low levels of wealth in the next;

- Many families living in poverty lack transaction accounts such as basic checking and saving accounts, which help to establish financial stability and build financial assets;

- Low-income families typically cannot take advantage of policies that structure and subsidize asset building in wealthier American households.

In today’s economy, almost everyone is being forced to make financial choices. The cost of gas, food, and clothing surge; incomes remain flat, and unemployment high. Therefore it is essential for social scientists to study the money practices within families to advance economic stability and financial wellness of individuals, families, and communities, with particular attention to vulnerable populations.

Community-Based Research Project

The community-based research project was aimed to understand the attitudes, beliefs, and perceptions regarding current money practices of the residents of Charlotte’s Northwest Corridor. This project served as a platform to assist residents and business owners of the Northwest Corridor in individual and community wealth building.

The theories that guided the project were the Ecological Perspective, Behavior Economic Theory, and Social Development Approach. These theories provide a framework that encompasses cognitive, affective, behavioral, and learning factors of individuals. These factors are essential in understanding the behaviors that impact money practices.

The purpose of the study was to understand the attitudes, beliefs, and perceptions regarding the money practices of the residents of Charlotte’s Northwest Corridor. The following research questions guided the study:

- Are persons that were economically socialized from their family of origin more prepared to practice financial principals and prepare for long-term financial success than persons that were not economically socialized within their family of origin?

- Does family structure impact the financial dynamics of the family?

- Are persons that have a good understanding of their financial literacy in a better financial situation than persons who do not have a good understanding of their financial literacy?

The survey instrument that was utilized in the study was the Economic Education Survey, developed by Dr. Margaret Sherraden of Washington University in St. Louis. Survey questions are categorized in the following categories: cognitive/affective, behavioral, and learning. Students enrolled in the course and the author added additional questions relevant to the sample population. Interview questions were open-ended and explored the early experiences of sample participates regarding financial education, economic well-being, financial management, savings attitudes and behaviors regarding money beginning in childhood and extending to the present. Closed-ended questions were regarding demographics.

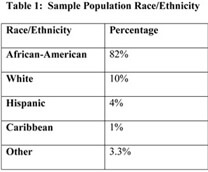

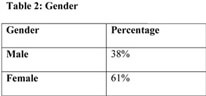

The study sample consisted of 150 residents of the three neighborhoods in the Northwest Corridor. The neighborhoods were: Smallwood-Biddleville, Lincoln Heights, and Washington Heights. Every third residence along each side of the street in each neighborhood was sampled. Prior to the study beginning, student researchers distributed a letter to residents outlining the purpose of the study, interview content, length of the questionnaire, confidentiality, dates the study will be conducted, and incentives. Each study participant received a financial planner for participating in the study. All interviews were conducted face to face in the homes of sample participants in July 2012. Interviews were conducted in the late afternoon, early evening, and on the weekend so that participants who worked were able to participate in the study.

Analysis

Demographics

Research Question One:

Were persons who were economically socialized from their family of origin more prepared to practice financial principals and prepare for long-term financial success than those who were not economically socialized within their family of origin?

Study participants that were economically socialized from their family of origin reported the principals they were socialized as a child with prepared them to prepare long-term for financial success in their adulthood. The majority of these respondents were 65 years old, retired, and a college or graduate school graduate. Participants reported that they economically socialized their children to prepare them for long-term financial success as well.

A small percentage of study participants that were not economically socialized as a child reported they felt that it was essentially for them to develop good money practices as an adult that would help them prepare for long-term financial success. These participants would like to receive financial planning assistance.

Study participants reported the person that they learned the most about money practices was their mother (62%), followed by their father (37%). Participants reported the following lessons they learned from their parents about money.

- Save for a rainy day

- Live within your means

- Maintain good credit

- Pay bills on time

- Pay bills in the order of importance

- Splurge a little

- Pay your tithes

- Sometimes you have to rob Peter to pay Paul

Research Question Two:

Does family structure impact the financial dynamics of the family?

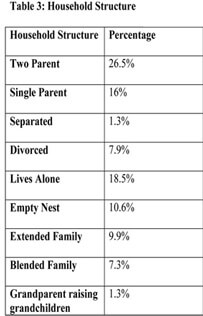

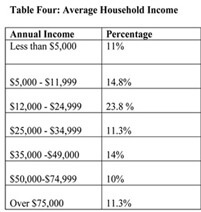

Twenty eight percent of the sample population reported that their family household structure consisted of a two parent family system. Eighteen percent reported that they lived alone, and sixteen percent reported they were a single parent. The majority of the participants reported their children were grown and lived outside of the home. These participants reported that they are financially stable and do not have any issues regarding money practices. Participants who had children reported their annual income was between $16,000 and $24,999 and $35,000 -$49,999. Sixty-eight percent of the sample population reported that they own their own home.

Study participants reported that they feel in control of their life and money; however, study participants with children reported the following feelings toward their financial security:

- They run out of money before the end of the month

- They feel stressed about money

- They have to accept their financial situation

- Know that they need to save but they don’t

- Wished they understood more about investing

- Don’t know their FICO score

Research Question Three

Are persons who have a good understanding of their financial literacy in a better financial situation than those persons who do not have a good understanding of their financial literacy?

Study participants who reported that they did not have a good understanding of their financial literacy reported the following:

- Think they should have a budget but they don’t

- Agonize that they may never be able to retire

- They are interested in improving their credit score

Conclusion

This course was designed around a community-based research project on financial literacy and education. Based on the principles of Financial Social Work, students within the classroom learned how to assist individuals and families with the tools and skills to help them understand how their relationship with their money drives their financial behavior. Results of this community based research project were shared with the residents and business owners of the Northwest Corridor. Students from the class and the professor are working with the Northwest Corridor Community Board to develop workshops and training programs for the residents around asset-building, developing financial security programs, saving plans, and debt reduction based on the data from this project.

References

Caner, A. and Wolff, E. (2004). Asset poverty in the United States poverty. Annandale-on-Hudson NY: Levy Economics Institute of Bard College.

Council on Social Work Education. (2012, August). Educational policy and accreditation standards. Retrieved from http://www.cswe.org/File.aspx?id=13780

Fields, J. (2004, November). America’s families and living arrangements: 2003. Washington, DC: U.S. Census Bureau.

Lundberg, S and Pollak, R (2007). The American Family and Family Economics. Journal of Economic Perspectives 21(2), 3-16.

Sigle-Rushton, W. & McLanahan, S. (2002). For Richer or Poorer? Marriage as an Anti-Poverty Strategy in the United States. Population (English Edition) 3(57), 509-526. DOI: 10.3917/pope.203.0509.

Soul of the Community (2012) Charlotte, NC—MSA. Retrieved from http://www.soulofthecommunity.org/charlotte

Spring 2013: New Faces, New Expectations